Finllect

Better financial health for the next-gen.

Project Description

What's Finllect?

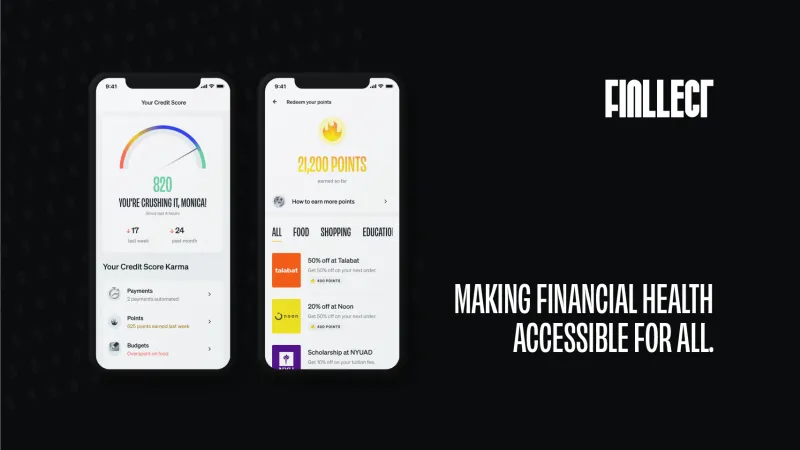

Finllect is an application for underserved thin or no file next-gen consumers to build credit, prequalify for financial services, and automate their finances. Instead of analysing income, credit history, or credit history, Finllect enables next-gen consumers to build responsible credit using recurring micro-payments and their ability to meet budgets.

What's the problem?

The majority of young adults do not have viable ways of building credit. Many of them don’t know their credit score or don’t know how to improve their current one. Once they do decide to start their credit journey, they are left frustrated when told the main way to build credit is through having the credit products they don’t yet qualify for.

While banks have doubled down on technology, infrastructure, and even hiring the right people, access to credit in the MENA remains unchanged. 60% of the MENA includes next-gen consumers who are eligible of being part of formal financial services and are actively looking to do so but simply do not fit the age-old boxes created by financial institutions in assessing creditworthiness. Globally, the MENA region has the lowest per-pocket-spend into credit products.

How does Finllect solve this?

Finllect offers a free, accessible, and scalable alternative to traditional credit. Finllect's credit score engine leverages allows next-gen consumers to build a credit score using real-time financial history, behavioral insights, and past payments. The application accurately categorizes the end-user's income, borrowings, and expenses and identifies recurring micropayments (rent, utilities, subscriptions, gas, and telco).

Finllect also assesses the end-user's earning potential and ability to meet budgets to create a digital financial identity which is reported to financial institutions. With Finllect, next-gen consumers can instantly pre-qualify for financial services within the application without any further paperwork required. In case of a rejection, Finllect offers a personalised credit repair program with actionable steps for the end-user to rebuild and/or repair their credit history. The application also offers bite-sized financial content and tools to enable the next-gen to add accuracy in improving their financial health.

How does this work?

Finllect's score empowers, educates, and enables the next-gen to demonstrate creditworthiness using an individual’s character or 'willingness to pay'. The Finllect score ranges from 1 to 900, with higher scores representing a lower propensity to default. Finllect offers a 30-day cycle that enables next-gen consumers to access real-time increase in their credit score. Finllect analyses the end-user's transactional history by directly connecting to its bank account.

Updates

The Campaign FAQs

Want to learn more about Finllect? Contact us at [email protected].

The application is available in English on the App Store and Play Store.

Thank you for supporting us.

Rewards

Thank you for supporting us.