P is for the Paycheck Protection Program

BY KAREN CAHN, Founder & CEO, IFundwomen

April 2, 2020

My people: Free money is coming your way through the Paycheck Protection Program.

I'm serious, read on.

If you run an SMB, which is fancy speak for small or medium-sized business, you already know that on Friday, March 28, 2020, Congress passed the CARES Act. Like SMB owners everywhere, I jumped into action.

But my action wasn't to apply for all of the aid that was becoming available. My action was to learn all I could about the bill to pay forward that knowledge to entrepreneurs at IFW.

So, I lightly "trolled" the internet to find the best source of information. On Friday night, I posted this straightforward graphic on my IG, FB, Twitter, and LinkedIn.

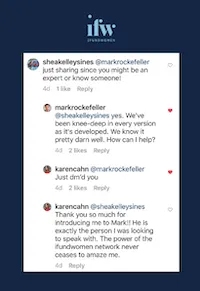

Saturday morning, I woke up to find my social inboxes filled with experts, including a random guy named Mark L. Rockefeller.

Being that I was on a quest for the best, most accurate information for my entrepreneurs at IFW, I was willing to talk to anyone. And thankfully, Mr. Mark L. Rockefeller was willing to talk to me on Saturday night. He was incredibly humble, generous with his time (thank you to Mark's family for letting me steal him for an hour on a weekend night), yet totally confident in his ability to give me honest, real-time information that was accurate. He caveated most statements with "this may change" or "we still aren't sure," which game me comfort that he wasn't overpromising anything.

Let me tell you about Mark: Aside from being a Veteran (he served as a captain in the United States Air Force for 7 years), he is a lawyer, and a FinTech founder, living in D.C. Mark read and consulted on the CARES Act before it passed and his company, StreetShares, was already set up to handle the onslaught of loan requests that were to come. StreetShares is on of the front-end technologies that will connect loan seekers to banks.

BINGO. I FOUND THE PERSON. Mark is close to the legislation, the technology, and the banks.

Here's a fun fact I learned from Mark: The banks who are servicing the loans are still TBD! I learned from Mark that only 1-2% of brick and mortar banks (think your local Chase or Bank of America) are set up to do online loans. That's why companies like Kabbage and others have crushed the online lending space all these years - because you literally cannot apply online at a traditional bank.

According to Mark, at a high-level, the entities who are eligible for PPP must:

- Be a business, nonprofit, veterans organization, or tribal business; this includes sole proprietors, independent contractors, and self-employed individuals

- Have been in operation on February 15, 2020

- Have employees for whom the business paid salaries and payroll taxes (this includes full-time and part-time employees, and those employed on any other basis, such as independent contractors, as reported on a Form 1099-MISC)

- Employ fewer than 500 employees (with certain expectations)

And here's how it works:

- You multiply your payroll by 2.5, and get a loan for that amount so everyone can keep their jobs and not get laid off (that's the point of the PPP: to stop layoffs on Main Street)

- If you keep the same payroll expenses for the next 4 months, the loan is automatically converted into a grant, a.k.a. debt-free money (the best kind!)

Here is a teaser of the 1-hour talk Mark generously gave to the IFW members.

To watch the entire talk, and if you are an SMB who wants THE REAL, you need to watch this. Click on over to IFW to watch the whole thing. It's free. (Just pay it forward to a woman entrepreneur one day, ok? Karma and whatnot...)

To see if your SMB qualifies for the PPP, run, don't walk, over to StreetShares where there's a simple-to-use PPP loan calculator. For more info, you can also read the FAQ on Mark's LinkedIn.