IFW is the golf course for female entrepreneurs

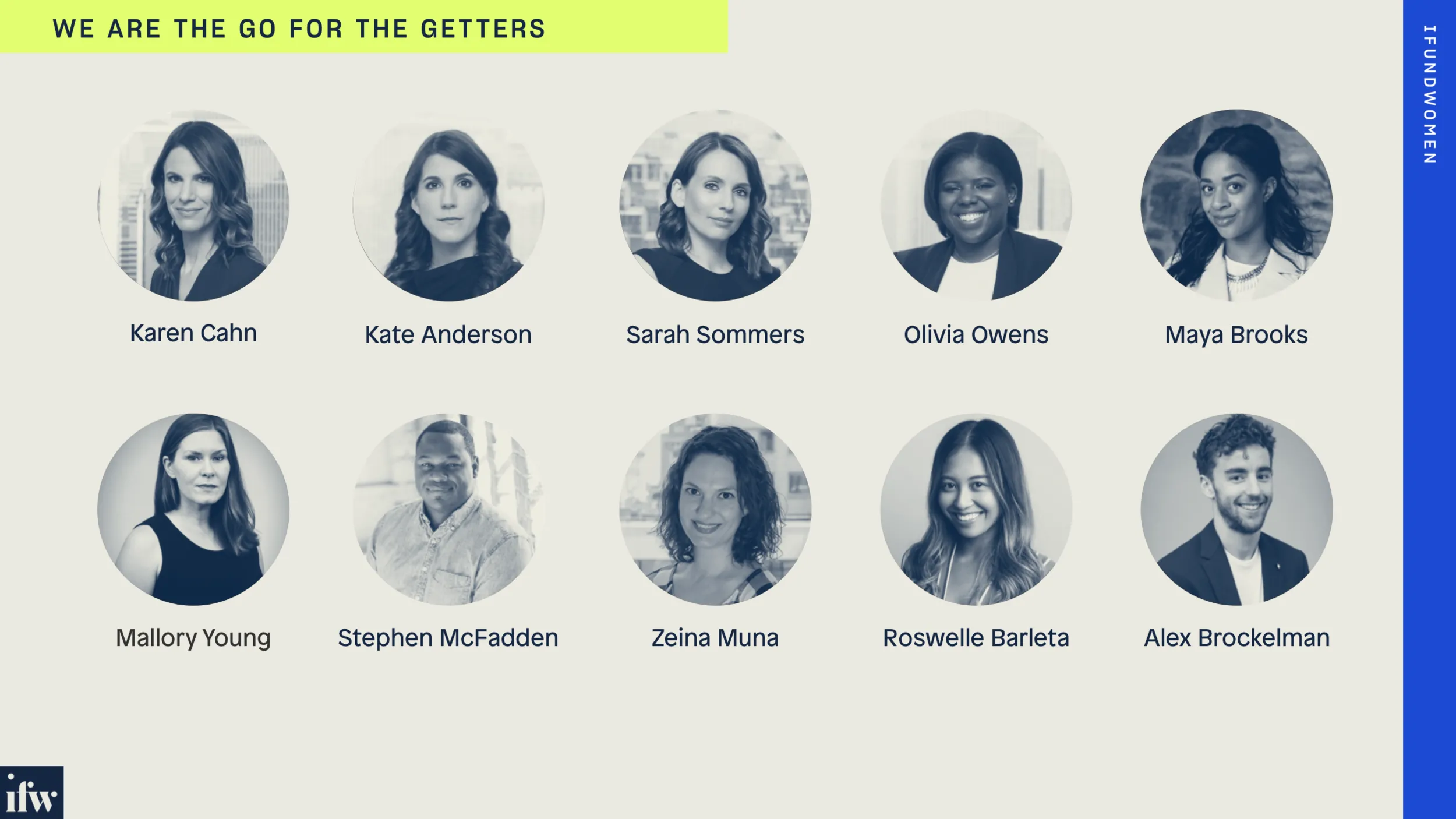

BY KAREN CAHN, FOUNDER & CEO, IFUNDWOMEN

NOVEMBER 14, 2019

We just concluded a 1,095 day beta test. The test was to see what would happen if we created our own “golf course” - a place where female entrepreneurs get access to the capital, coaching, and connections critical to launching and growing their businesses. Men have long had access to capital and connections all while playing 18 holes for decades. Now women entrepreneurs have a place to play too.

If we built it, would they come, and more importantly, would it work? The answer is yes and yes.

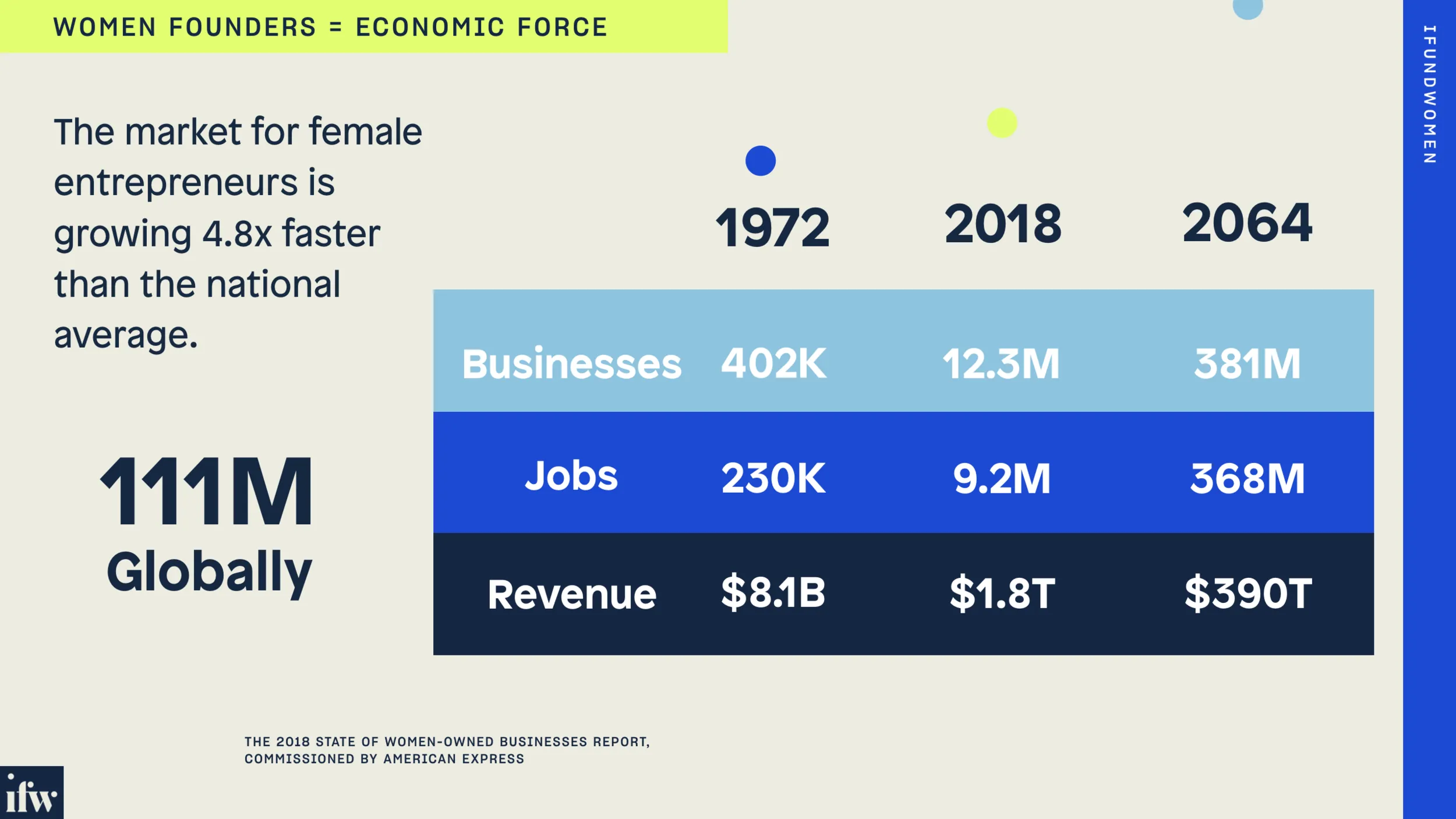

Did you know that there are 111 million female entrepreneurs globally who are ideating, building, launching, pivoting, or marketing a product or service? There are 12.3M in the USA alone and this market is on fire and growing 4.8x faster than the national average.

We launched IFW because we were trying to solve a problem we ourselves had as female entrepreneurs: there was literally no place to go to get debt-free, early stage capital to test our ideas and to launch our businesses without racking up credit card debt or wasting years of our lives chasing an equity round that was never going to happen.

ICYMI: In 2018, only 2.2% of VC dollars went to women with less than half a percent going to founders of color.

After working with thousands of entrepreneurs, we know that women need ACCESS + ACTION. Access to funding. Access to experts who have been there, done that and who can create actionable steps to get you there. Access to tools and resources that literally show you how to startup and raise money. Access to like-minded entrepreneurs. And yes, access to the money dudes in Silicon Valley who can fund them with big checks - shout out to Marc Benioff’s Salesforce Ventures for writing a big check to Sallie Krawcheck’s Ellevest.

Lots of famous venture capitalists like Ben Horowitz, co-founder of Andreessen Horowitz and author of What You Do Is Who You Are: How to Create Your Business Culture, are now talking about how more money should be invested in women and people of color, and VCs should “widen the band” on who they both hire at the firm, and the founders they fund. I happen to like the phrase that Horowitz uses “widen the band” because at least it’s honest.

But I would argue that widening the band isn’t enough because you’re only really bending on a couple of data points that make up the pattern matching algorithm that matches founders to funders.

The Sand Hill Road algo tends to look for the following criteria:

- Founders who have had a successful exit or IPO

- Founders who have worked at a Unicorn company in the engineering or product org

- Two Founders preferred, and one must be technical

- Has a CS degree

- Has any of the following words in their pitch deck: Crypto, Computational Biology, AI, FinTech, SaaS

- Is a close friend of one of their adult children

Sisters, ask yourselves...do you fit into any of these criteria? I do. I fit into #5 because iFW is a FinTech solution, and I sort of fit into #2 because I worked at a unicorn company, Google, and was there well before the IPO and after it, so I have lived and thrived in a historic, high frequency environment. I was known at Google as being one of the most decorated OC (operating committee award-winning) sales execs who came up with lots of new ideas and was able to both execute and monetize anything I could dream up.

So, given that as a female founder who ticks one and a half boxes, and given the increased interest and discussion in Silicon Valley around funding female founders, you’d think that I would become a founder that should easily get funded right?

Wrong.

I’m not an engineer and I don’t have a technical cofounder, and even with a FinTech business with ARR approaching $1M, it still seems to be a problem for brand name VCs. Either that, or I just don’t have access to them. As an eternal optimist, I’m choosing to think that it’s the latter - I don’t have access.

Reshma Saujani is the pioneer who, back in 2012, understood the pattern matching that was happening in VC, so in order to address #4 which is propel more women into engineering positions, she started Girls Who Code, teaching computer science skills to nearly 200,000 young women and launching mentoring programs across the country.

In an interview with Kara Swisher on my fave podcast, Recode Decode, Saujani said: “Year after year after year, I get emails from my students saying, ‘I applied to Google, I applied to Microsoft, I applied to Facebook. I’m a 4.0 MIT student, Berkeley, Stanford, you name it. Can’t get my foot through the door..... [And] you still have all-white-male panels. You still have a culture that is not welcoming to women and people of color.”

“I don’t even know if I can change the culture of Facebook, I don’t know if I can change the culture of Sequoia,” Saujani added. “I don’t know. I have not seen the type of change that I’d like, and so we may have to just throw our hands up and say, ‘Instead of continuing to try to change the establishment, let’s make our own establishment.’”

I agree with Ms. Saujani. We’ve built our own establishment and in my mind, IFW is the new golf course, where female founders get access to capital, access to coaches and mentors who provide tangible, actionable steps they can take to start their businesses off on the right foot, and access to a community of entrepreneurs who both look like you and have done it before.

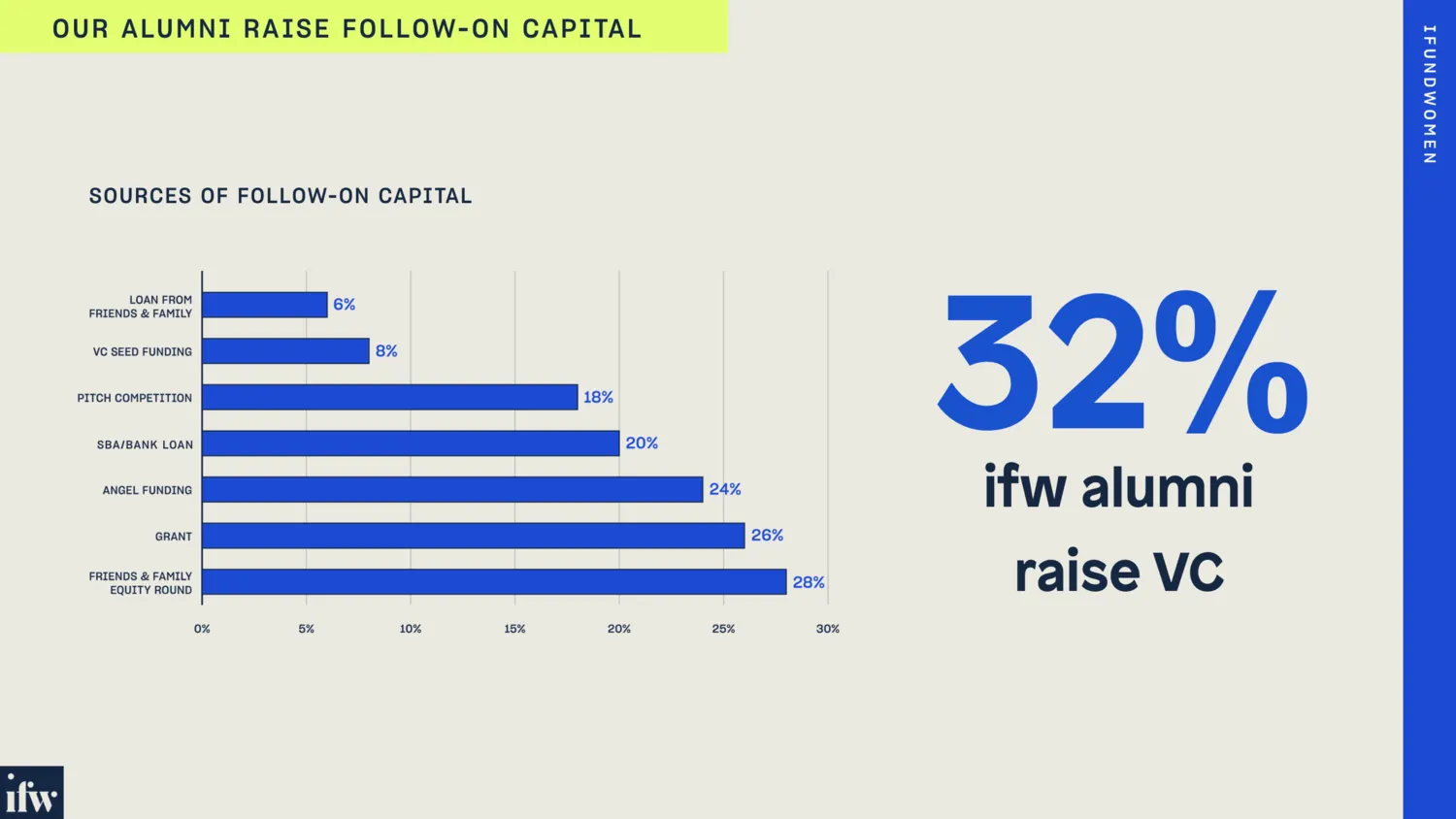

And our results so far are pretty damn good.

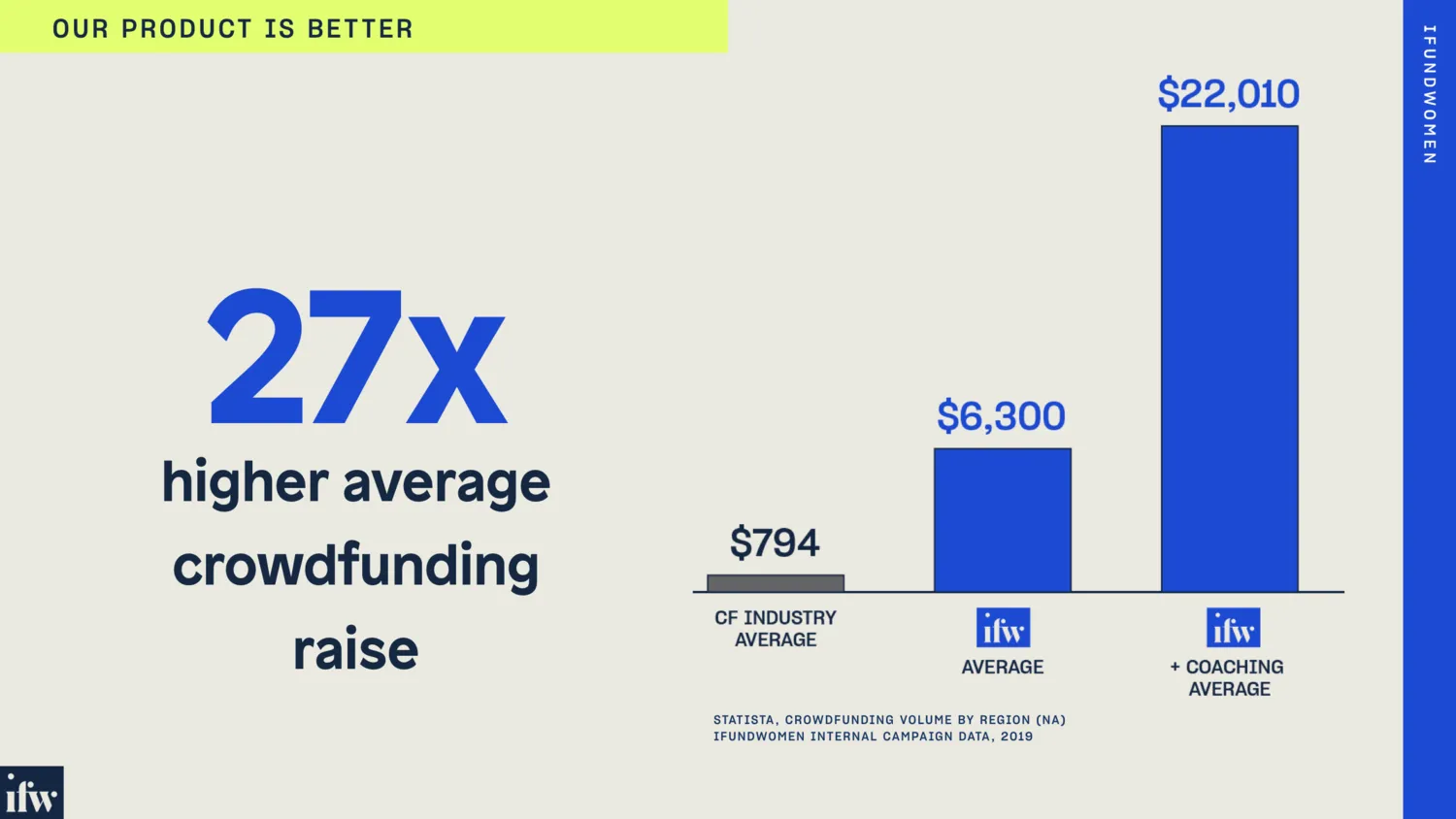

Our product is better.

Entrepreneurs who use all products on IFW’s platform raise 27x the crowdfunding industry average, and become exponentially more prepared to build successful companies.

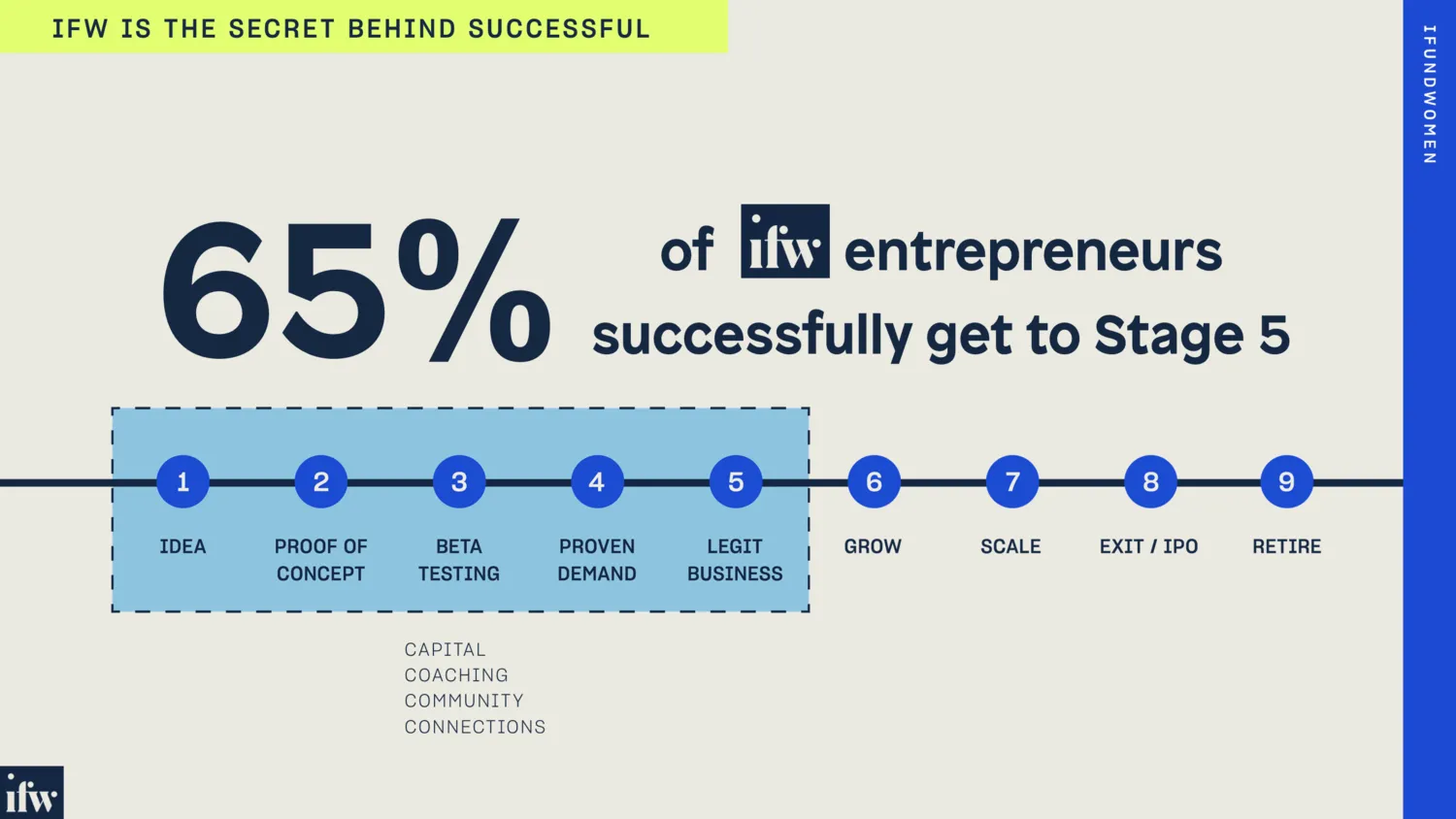

We are the secret behind the successful.

92% of startups fail, but 65% of IFW alum succeed.

Why? Because our proprietary, on-demand coaching service literally teaches founders everything they need to know to grow their ideas from “tech product for non-technical founders” to “how to do Facebook retargeting ads” to “who is my customer and what exactly am I selling them”.

We are the secret behind the successful.

92% of startups fail, but 65% of IFW alum succeed.

Why? Because our proprietary, on-demand coaching service literally teaches founders everything they need to know to grow their ideas from “tech product for non-technical founders” to “how to do Facebook retargeting ads” to “who is my customer and what exactly am I selling them”.

Let’s talk about access to connections who can propel your business forward.

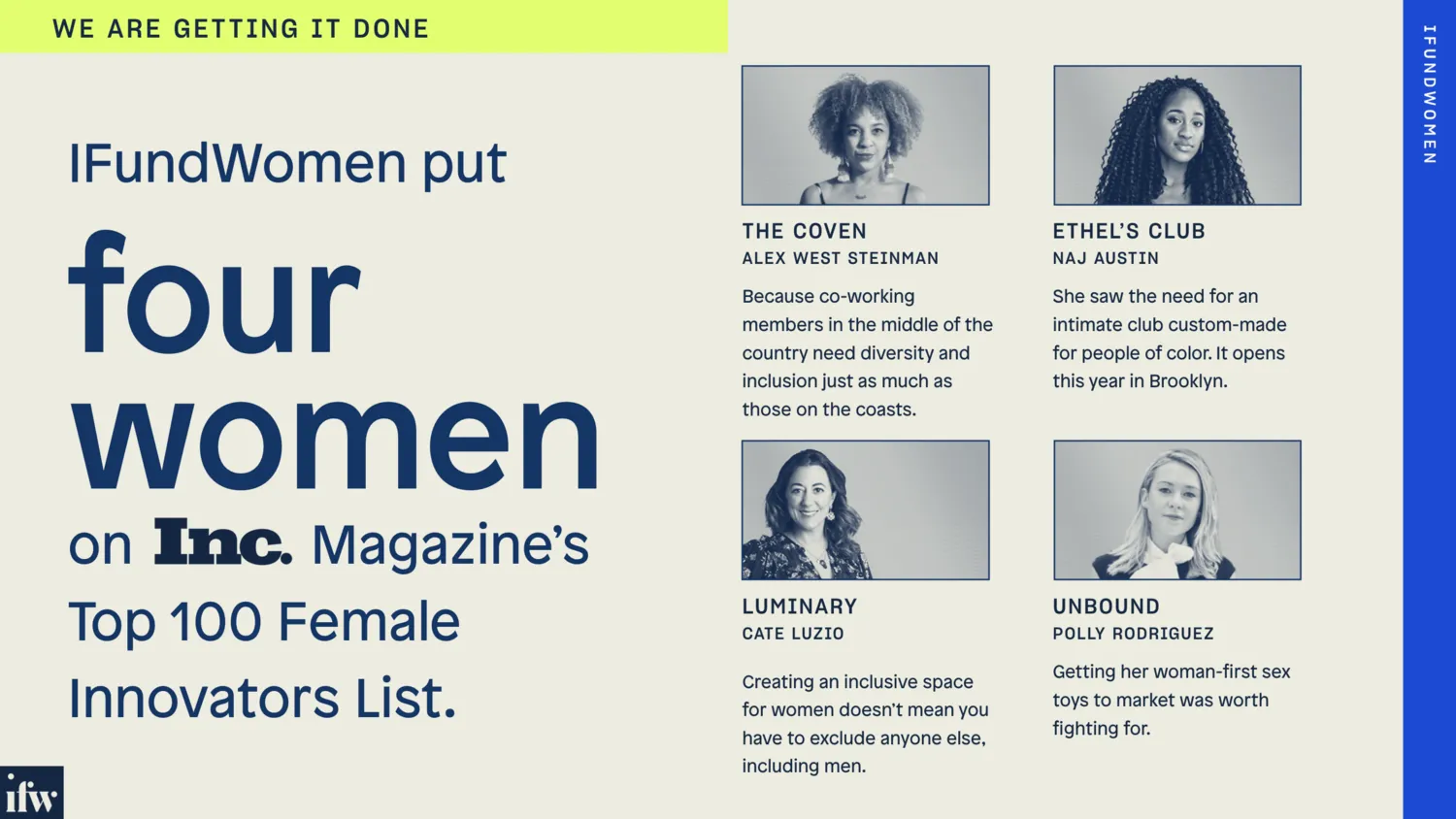

In 2019, IFW was responsible for putting four women on Inc. Magazine’s top 100 female innovators list. The people who create these top “most important xyz” lists, also known as “The Press”, are generally inaccessible to entrepreneurs. The entrepreneurs who raised their first round of capital on iFW were put into a machine that promoted them in OUR press and connected them to influential publicists who had them top of mind when submitting their picks to these lists. While these “Top 100” lists seem like something founders should not focus on, and to be clear they shouldn’t, make no mistake, they are critically important to getting oticed by VCs and customers in the space.

In conclusion, our 1,095 day beta test was successful.

Thank you to all of the founders, funders, entrepreneurs, and investors who believed in us from day one, even though nobody on the founding team has a CS degree from Stanford.